The Complete Guide to Understanding Residential Investment Property Outgoings

It's no secret that investing in property can be a lucrative endeavour. In fact, when it comes to making a long-term investment, few options can match the potential of residential property.

But there's more to consider than just the purchase price when you're budgeting for a residential property investment. You'll also need to factor in ongoing costs like insurance, council rates, and strata fees (if applicable), as well as potential repairs and renovations down the track.

Of course, you'll also need to factor in the cost of your mortgage repayments. All of these factors will impact your return on investment, so it's important to do your homework before you take the plunge. If you're mindful of all of the costs involved, investing in residential property can be a great way to secure your financial future.

So, to help you navigate the research aspect of residential property investing, here is a guide to understanding the typical outgoings on a residential property.

What are Outgoings?

Outgoings are the expenses that you’ll likely incur from owning a residential rental property. These can include things like general maintenance, insurance, council rates, and strata fees. Your lease agreement will generally dictate who is responsible for paying these costs—you or your tenant.

If you, as the owner, are responsible for the bulk of the expenses—which is usually the case with residential investments—you need to properly account for them, because they will make a difference to your bottom line.

By carefully managing your outgoings, you can help maximise your profits and minimise any losses. So it's definitely worth keeping a close eye on them.

It’s worth noting that if you have a property manager on your team (which I would highly recommend), you can outsource all these payments to your property manager, which will save you considerable time and hassle.

Typical Residential Property Outgoings

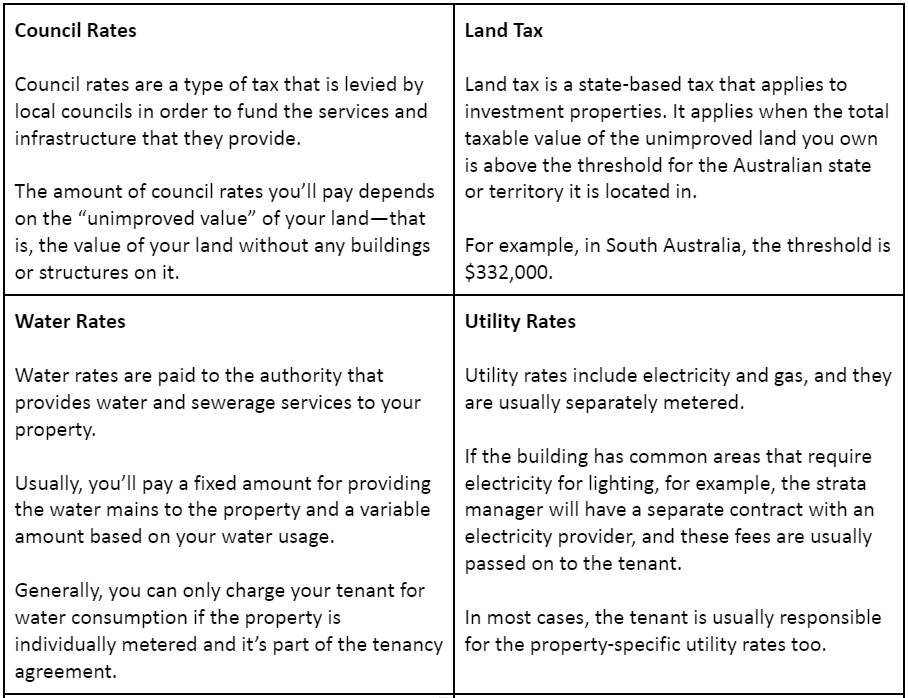

Let’s look at some of the typical outgoings on a residential property.

Key Takeaways

Investments are a huge financial decision and not one to be taken lightly. When you're considering an investment property, it's important to ensure that you can afford to pay the deposit, meet your mortgage commitments and all the property outgoings such as council rates, land tax and insurance.

Unexpected repairs can throw your entire budget off, so it's crucial to factor in a buffer for unforeseen circumstances.

If you would like to know more about these outgoings as well as the ins and outs of residential property investing, make sure to check out my book, Residential Property Investing Explained Simply.

Alternatively, if you would like to know how I’ve successfully helped my clients execute 1,000 residential property acquisitions, get in touch today.